Guided Wealth Management Can Be Fun For Anyone

Table of Contents7 Simple Techniques For Guided Wealth ManagementSome Known Factual Statements About Guided Wealth Management Guided Wealth Management for BeginnersThe 7-Minute Rule for Guided Wealth Management3 Simple Techniques For Guided Wealth ManagementGuided Wealth Management Things To Know Before You Buy

Picking an efficient economic consultant is utmost crucial. Do your study and spend time to evaluate possible financial advisors. It serves to place a huge initiative in this process. Perform an evaluation amongst the prospects and select the most certified one. Expert functions can vary depending on several variables, including the sort of financial consultant and the client's demands.A restricted expert ought to proclaim the nature of the restriction. Supplying appropriate plans by analyzing the history, financial information, and capabilities of the client.

Supplying critical plan to coordinate individual and organization finances. Directing clients to carry out the economic plans. Evaluating the carried out plans' efficiency and upgrading the applied strategies on a routine basis on a normal basis in different stages of clients' development. Routine surveillance of the financial portfolio. Keep tracking of the client's activities and verify they are following the right path. https://www.anyflip.com/homepage/emzdt#About.

If any kind of issues are run into by the management experts, they sort out the root triggers and resolve them. Develop a monetary threat analysis and assess the prospective impact of the danger. After the completion of the risk evaluation design, the advisor will examine the outcomes and supply an ideal solution that to be implemented.

Not known Facts About Guided Wealth Management

In a lot of countries experts are used to conserve time and minimize tension. They will assist in the accomplishment of the financial and employees objectives. They take the duty for the offered decision. Therefore, clients need not be concerned concerning the decision. It is a lasting procedure. They require to study and assess more locations to line up the best course.

But this led to a boost in the net returns, cost financial savings, and likewise directed the path to profitability. Numerous steps can be contrasted to identify a certified and skilled expert. Generally, consultants need to satisfy standard academic qualifications, experiences and accreditation suggested by the federal government. The standard educational credentials of the expert is a bachelor's degree.

Always make certain that the advice you receive from an advisor is constantly in your best rate of interest. Eventually, monetary advisors take full advantage of the success of a company and also make it expand and grow.

Getting My Guided Wealth Management To Work

Whether you need a person to aid you with your tax obligations or supplies, or retirement and estate preparation, or all of the above, you'll locate your answer right here. Maintain checking out to discover what the difference is in between a financial expert vs organizer. Essentially, any kind of expert that can aid you handle your cash in some fashion can be considered an economic advisor.

If your goal is to develop a program to meet lasting economic goals, then you probably want to enlist the solutions of a qualified economic planner. You can look for a planner that has a speciality in taxes, investments, and retirement or estate planning.

A monetary consultant is just a wide term to define a specialist that can aid you manage your money. They may broker the sale and purchase of your stocks, manage investments, and assist you create a thorough tax obligation or estate strategy. It is essential to keep in mind that a monetary consultant must hold an AFS permit in order to offer the public.

The smart Trick of Guided Wealth Management That Nobody is Discussing

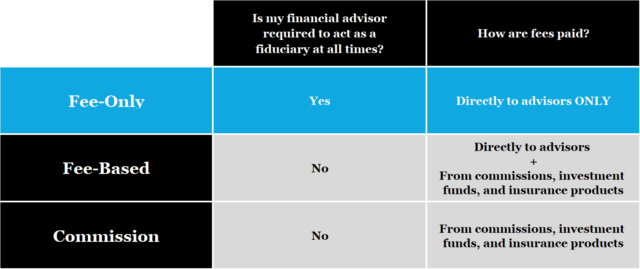

If your economic expert lists their solutions as fee-only, you must expect a listing of solutions that they provide with a failure of those fees. These specialists do not use any kind of sales-pitch and typically, the solutions are cut and completely dry and to the factor. Fee-based advisors charge an upfront fee and afterwards gain payment on the economic items you buy from them.

Do a little research first to be sure the financial advisor you hire will be able to take treatment of you in the lasting. Asking for referrals is an excellent means to obtain to know webpage an economic consultant before you also fulfill them so you can have a far better concept of how to handle them up front.

The 8-Second Trick For Guided Wealth Management

Make your potential expert address these inquiries to your contentment before relocating onward. You might be looking for a specialty expert such as someone that focuses on separation or insurance policy preparation.

A financial advisor will help you with setting attainable and reasonable objectives for your future. This can be either beginning a company, a family members, preparing for retired life all of which are necessary chapters in life that need careful consideration. A financial expert will take their time to review your scenario, short and long-term goals and make suggestions that are best for you and/or your household.

A research from Dalbar (2019 ) has actually shown that over 20 years, while the average investment return has actually been around 9%, the ordinary financier was only getting 5%. And the distinction, that 400 basis points each year over twenty years, was driven by the timing of the investment decisions. Manage your portfolio Safeguard your assets estate preparation Retired life intending Manage your super Tax obligation financial investment and monitoring You will be needed to take a danger resistance survey to supply your advisor a clearer picture to determine your investment possession allotment and choice.

Your consultant will analyze whether you are a high, tool or low threat taker and established up a possession appropriation that fits your threat resistance and capacity based upon the details you have actually given. A high-risk (high return) person might spend in shares and residential or commercial property whereas a low-risk (low return) individual might want to invest in cash and term deposits.

The Best Guide To Guided Wealth Management

Therefore, the much more you save, you can choose to spend and build your wide range. When you involve a financial consultant, you don't have to handle your profile (financial advice brisbane). This conserves you a great deal of time, initiative and energy. It is necessary to have appropriate insurance policy plans which can offer tranquility of mind for you and your family members.

Having a financial consultant can be incredibly helpful for several individuals, but it is very important to evaluate the pros and cons prior to making a choice. In this post, we will certainly explore the advantages and downsides of working with a monetary expert to aid you determine if it's the best action for you.

Comments on “The Guided Wealth Management Ideas”